TL;DR: Approximately 30% of financed collections accounts fail within the first year, triggering “file replacement obligations” that can force you to replace more accounts than you onboard—a death spiral that destroys cash flow. This post reveals the most common traps and the operational benchmarks you need to hit before financing becomes viable instead of fatal. Bottom line: Optimize first, finance later.

You’ve built a solid collections or debt settlement business. Revenue is growing, clients are onboarding, and everything looks great on paper. Then your finance company calls with an enticing offer: “We’ll advance you 60-70% of your expected collections upfront. Scale faster, hire more staff, take on bigger portfolios.”

It sounds like the breakthrough you’ve been waiting for. But for many collections companies, especially those new to the industry, financing becomes a death sentence rather than a lifeline.

Here’s the brutal truth: approximately 30% of financed collections accounts fail within the first year. And when they fail, you don’t just lose revenue—you owe money back. The mathematics of file replacement can create a spiral that’s nearly impossible to escape, where you’re replacing more accounts than you’re onboarding, drowning in obligations while your cash flow turns negative.

But it doesn’t have to be this way. We’ve worked with companies that achieved 15-21% liquidation rates, implemented proper communication systems, and built operational maturity to Level 3 before pursuing financing. These companies used financing to scale from $2M to $10M+ in annual revenue without hitting the replacement death spiral. The difference? They optimized operations first and financed later.

At MintGroup, we’ve watched companies make this mistake repeatedly. We’ve also helped companies avoid it by optimizing their operations first. The difference between financing success and financing disaster isn’t luck—it’s operational readiness.

1. The File Replacement Death Spiral

This is the killer that most companies never see coming.

Here’s how it works: You receive financing on 1,000 accounts, getting an advance of perhaps 60% of expected collections. Within 12 months, industry data shows that 300 accounts (30%) will drop out. That’s standard attrition.

But here’s the catch—under most recourse financing agreements (where you’re responsible for account performance), you must either buy back these failed accounts by returning the advance, or replace them with performing accounts of similar quality.

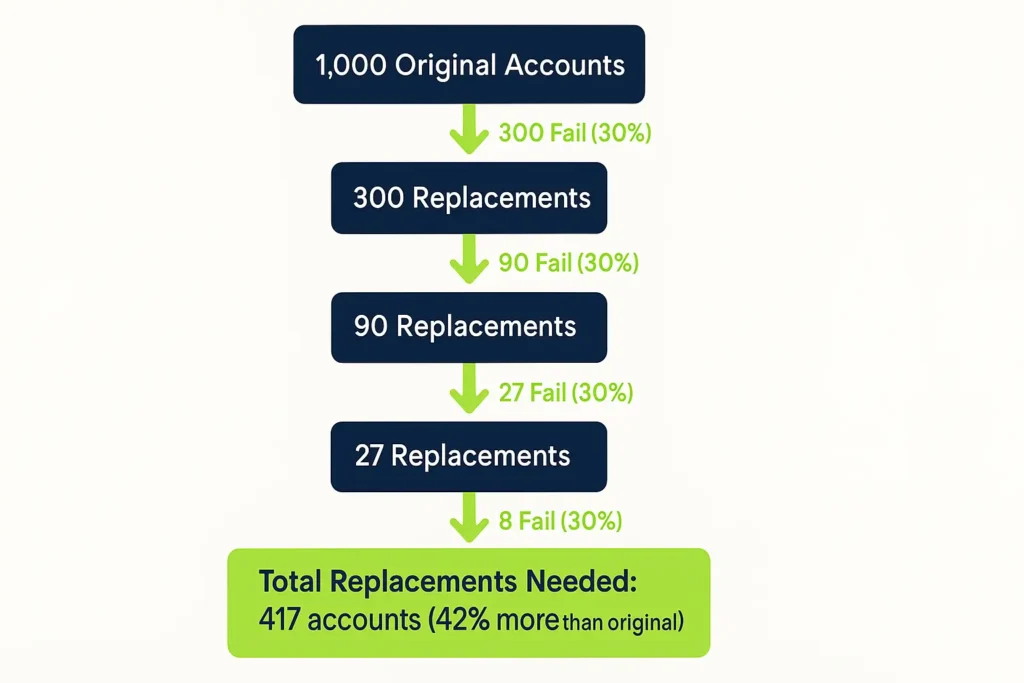

So you replace those 300 accounts. But guess what? Those replacement accounts also carry a 30% failure rate. That’s 90 more failures. Those 90 need replacements, which fail at 30%, creating 27 more failures. The cycle continues.

By the time the math plays out, you need to replace 417 accounts—42% more than your original failures.

Now scale that to your full portfolio over 24-48 months. If 50% of accounts ultimately fail (the industry average for debt settlement), you don’t just need to replace 500 accounts—you need to replace closer to 714 accounts to maintain projected cash flows.

The Drowning Point

The death spiral accelerates when replacement obligations exceed your new client acquisition capacity. You’re spending more time, money, and resources replacing failed accounts than acquiring new business. Cash flow turns negative as you return advances on accounts that will never generate revenue.

Warning: Companies caught in the replacement death spiral typically don’t realize it until they’re 18-24 months into financing, when the compounding mathematics become undeniable. By then, it’s often too late to fix.

The financing that was supposed to fuel growth becomes an anchor pulling you under.

2. You’re Operating Below Critical Return Rate Thresholds

Industry benchmarks aren’t suggestions—they’re survival lines.

Collections portfolios need liquidation rates (the percentage of debt actually collected) of at least 11-19% just to break even on typical financing terms. Companies achieving less than 11% shouldn’t pursue financing under any circumstances. The economics simply don’t work.

Here’s why these numbers matter:

- Portfolios purchased at 3% of face value need approximately 8-10% liquidation to be profitable

- Debt settlement programs average only 45-50% completion rates (meaning 50-55% fail)

- Standard collection agency recovery rates sit at just 20-30%

If your portfolio is performing in the bottom quartile, financing will amplify your problems, not solve them.

The Reality Check

Before pursuing financing, ask yourself:

- Are your liquidation rates consistently above 15%?

- Do you achieve recovery rates of 50% or higher?

- Are your completion rates at least 45%?

If you answered “no” or “I’m not sure” to any of these questions, you need operational improvements before financing.

3. Missing Communication Infrastructure Costs You 20-30% Performance

This might be the most underestimated operational failure in the collections industry.

Companies without automated payment reminder systems and SMS campaigns forfeit 20-30% of potential collections. That’s not an exaggeration—it’s documented across multiple industry studies.

Consider these facts:

- SMS messages achieve 98% open rates compared to email’s 40-50%

- More than 80% of people refuse to answer calls from unknown numbers

- The average person checks their phone 50+ times daily

- Recovery likelihood decreases approximately 1% for every week of delay

If you’re relying primarily on phone calls and manual follow-up, you’re missing the majority of your debtors during optimal collection windows.

Industry Stat: Companies with automated multi-channel communication systems achieve 60-80% reach rates compared to just 20-30% for phone-only approaches—a 150% improvement that translates directly to collection performance.

What This Means for Financing

When you receive financing on a portfolio expected to generate $2 million in fees, but your communication infrastructure is so poor that you only collect $1.4 million, you’ve created a $600,000 problem. You received advances based on $2 million. You’ll collect $1.4 million.

You owe $600,000 back to your lender—money you’ve probably already spent on payroll and overhead.

4. Your Timing Problems Create Compounding Losses

The timing of defaults makes everything worse.

Early failures (within 6-12 months) represent accounts where you’ve collected minimal fees but received 60-70% of expected total fees as an advance.

The math is brutal:

- Expected fees over 48 months: $2,000 per account

- Advance received: $1,200 (60%)

- Fees collected before account fails at month 6: $150

- Amount you owe back: $1,050

Now multiply this by hundreds or thousands of early failures.

Why Time Matters So Much

- After 6 months past due, debt is only 50% recoverable

- After 12 months, recovery drops to just 10%

- Every week of delay costs approximately 1% in recovery rate

Manual processes that create delays of days or weeks miss optimal collection windows entirely. By the time you make contact, the account is already substantially less valuable than when you received financing for it.

5. Your Portfolio Quality Deteriorates Through Replacement Cycles

Here’s an insidious problem that compounds the file replacement spiral: replacement accounts perform worse than original accounts.

Your initial placements typically represent your best available accounts—fresh, well-documented, with engaged consumers. When those fail and you need replacements, you’re pulling from whatever sources remain available:

- Older accounts with lower recovery potential

- More contested debts with documentation issues

- Lower quality consumers with worse payment histories

- Accounts other companies have already worked unsuccessfully

What started as 30% attrition in your prime accounts can climb to 40% or higher in replacement cohorts, accelerating the death spiral with each cycle.

The Path Forward: Optimize First, Finance Later

If this article has made financing sound terrifying, that’s intentional. Financing amplifies whatever operational foundation exists—excellence scales to dominance while mediocrity scales to disaster.

But done right, financing can be transformational. Here’s how to do it right:

Step 1: Achieve Operational Maturity (6-12 Months)

Before pursuing financing:

- Implement all three essential technology systems

- Document standardized processes

- Achieve consistent execution

- Build operational maturity to level 3 minimum

Step 2: Hit Performance Benchmarks (6-12 Months)

Demonstrate consistent performance meeting minimum thresholds:

- Liquidation rates: 11%+ (target 15-21%)

- Recovery rates: 45%+ (target 50-60%)

- Completion rates: 35%+ (target 45-50%)

- Profit margins: 10-15%+ (target 15%+)

- Positive cash flow: 6-12 consecutive months

Step 3: Build Infrastructure (Ongoing)

- Obtain all required state licenses

- Implement robust compliance monitoring

- Develop strong creditor relationships

- Build cash reserves for clawback obligations

Step 4: Structure Deals Carefully

When you’re ready:

- Understand recourse provisions fully

- Negotiate reasonable performance covenants

- Build in grace periods before default triggers

- Maintain multiple financing relationships

- Start small and scale based on proven performance

Are You Ready? Take This Quick Assessment

Answer honestly:

- Can you produce liquidation rates, recovery rates, and completion rates for the past 12 months?

- Are all essential technology systems fully operational?

- Do you have documented, standardized processes that execute consistently?

- Have you maintained positive cash flow for 6+ consecutive months?

- Are you properly licensed in all required states?

- Do you have cash reserves equal to 30-40% of potential financing advances?

- Are your current performance metrics above industry minimum thresholds?

If you answered “no” to any of these questions, you’re not ready for financing. More importantly, pursuing financing now will likely accelerate problems rather than solve them.

How Mint Group Helps Collections Companies Avoid the Financing Trap

At Mint Group, we’ve built our business around helping collections and debt settlement companies optimize operations before scaling. We’ve seen too many businesses destroyed by premature financing.

Our approach focuses on the fundamentals that make financing successful:

Operational Optimization: We help you implement the systems, processes, and infrastructure required to achieve top-quartile performance. This includes communication systems that improve performance by 20-30%, workflow automation that reduces costs, and compliance infrastructure that prevents violations.

Performance Improvement: We work with you to drive liquidation rates, recovery rates, and completion rates above minimum financing thresholds. This isn’t about marginal improvements—it’s about moving from bottom quartile to top quartile performance.

Business Operations: We help you build the operational maturity required for financing success. This includes documentation, standardization, metrics tracking, and continuous improvement systems.

The Right Sequence

Many companies approach us wanting help “landing financing.” Our response is usually, “Not yet.”

We’d rather spend 6-12 months helping you optimize operations, achieve consistent above-benchmark performance, and build proper infrastructure. Then, when you pursue financing, you’re in a position of strength. Lenders compete for your business. Terms are favorable. And most importantly, you have the operational foundation to handle scaled volume successfully.

Financing amplifies results—make sure you’re amplifying excellence, not mediocrity.

Ready to Optimize Your Operations?

If you’re a collections or debt settlement company considering financing, or if you’re already financed and facing challenges, we can help.

Get Your Free Operational Readiness Assessment

Our team has decades of experience in high-risk collections, payment processing, and business operations. We understand the financing landscape, the operational requirements for success, and how to build businesses that thrive with appropriate leverage.

Schedule a free 30-minute consultation where we’ll:

- Assess your current operational maturity level

- Identify your biggest financing risk factors

- Create a roadmap for sustainable growth

- Determine if you’re ready for financing (or what you need to fix first)

Contact Mint Group today at [contact information] or use the form below to discuss your operational readiness.

“We tell 60% of companies who approach us that they’re not ready for financing yet. Then we help them get ready. Our clients appreciate the honesty—and the results.” — MintGroup Team

Because the best financing decision is the one made from a position of operational strength, not operational desperation.

About MintGroup: We’re experts in helping collections and debt settlement companies improve their operational performance and payment processing. Our clients achieve 20-30% performance improvements through better systems, processes, and infrastructure. Whether you’re preparing for financing or optimizing existing operations, we can help you avoid the pitfalls that destroy unprepared companies.